Bali villa investment continues to attract significant interest from both international and local investors, guided by sustainable tourism demand and evolving property trends. As Bali’s tourism gripped for traction, demand for accommodation and related services surged, benefiting property owners with higher occupancy and rental income.

- Tourism Recovery:

- Tourist arrivals in Bali have seen a steady recovery, driving up occupancy rates for vacation rentals and increasing demand for long-term leases. Key tourism areas like Seminyak, Canggu, and Ubud remain highly desirable, but there’s also a notable shift towards emerging areas like Tabanan and North Bali as investors seek untapped opportunities.

- Freehold vs Leasehold:

- Foreigners cannot directly own freehold land in Indonesia, but they can secure long-term leases. Freehold (Hak Milik) is available only to Indonesian nationals, while foreigners can purchase leasehold (Hak Sewa) or usage rights (Hak Pakai) with renewable terms. Investors often weigh the flexibility and lower costs of leasehold against the permanence of freehold ownership for locals.

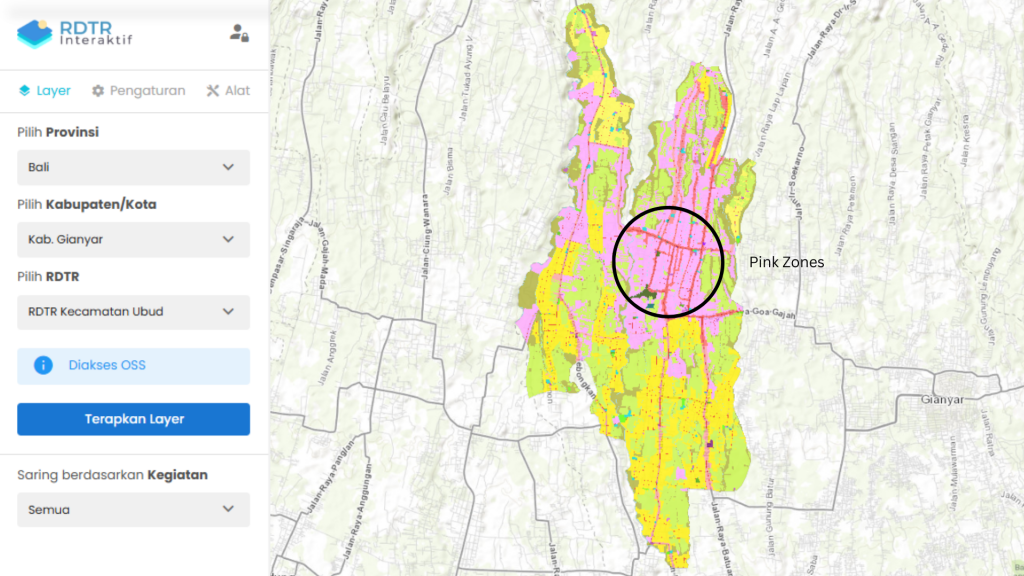

Basic Understanding: Decoding Zoning Colors

Bali Property Zoning and Regulatory Changes With development on the rise, understanding Bali’s zoning regulations is critical. The Indonesian government uses the GISTARU (Geospatial Information System for Spatial Planning) platform, an online resource providing up-to-date zoning and land use plans. This tool helps investors identify areas designated for tourism, residential, or commercial use, helping to avoid potential regulatory issues. The system also highlights restricted zones where certain types of construction are limited, supporting sustainable development in line with Bali’s conservation goals. There are 5 zones in Bali:

This is for farming and not suitable for building villas. There are strict regulations in place to protect farmland.

This zone is intended for building villas. However, different subzones allow varying densities of housing. Research is essential to find the right fit for your project.

This area is designated for businesses rather than villas. Understanding the nearby commercial zones can help you gauge the local economy and potential client base.

Ideal for building villas targeting tourists. These areas are designated for accommodations like hotels and villas, making them a favorable choice for villa projects.

These mixed-use zones are suitable for both businesses and housing. They offer a flexible option, allowing you to cater to both locals and tourists with your villa project.

Looking at this Bali property zoning, it’s clear that the pink zones are the safest for building villas, according to the rules. The map in Figure 1 shows an example of the Ubud area. Now, what’s important to figure out next is the exact location within the pink zone where you want to invest.

Choosing the Perfect Location by Balancing Between Zoning and Desirability

Using Airbnb Reviews Analysis as A Strategic Insight

For investors seeking prime opportunities in Bali, the Airbnb review map acts as a valuable compass. Imagine being in their shoes, eyeing the appealing pink areas on the map. The natural question that arises is, “Which specific spot within this pink zone is the most desirable?” The answer is surprisingly straightforward: look for the pink areas adorned with sizable green bubbles. These vibrant green bubbles, symbolizing satisfied guests, are a telltale sign of high desirability.

While this observation is promising, a direct investment decision isn’t good. So, what additional factors should investors consider? Let’s explore more with Bukit Vista to make an informed choice.

Maximizing Profit: Unraveling Return on Investment (ROI)

Once the pink area with a substantial green bubble is identified, the next crucial step in the Bali villa investment journey involves understanding the Return on Investment (ROI). ROI, short for Return on Investment, is a vital metric providing insights into the annual returns an investor can expect from a specific area. Various factors such as land price, operational costs, villa prices, and occupancy rates directly impact this percentage. Particularly in the A-labeled area, discerning the ROI becomes pivotal. If you’re keen to unravel this financial puzzle, reaching out to Bukit Vista is your next prudent move.

Conclusion: Your Bali Villa Investment Journey Begins

In the market of Bali’s real estate market, Bali property zoning as the land use regulation is the first stroke, desirability is the vibrant hue, and ROI is the masterpiece that follows. Armed with this knowledge, you’re not just an investor; you’re a strategic player in Bali’s evolving landscape. Let’s embark on this journey together. Reach out to Bukit Vista, where expertise meets opportunity, and let’s sculpt your investment dreams into a prosperous reality. Happy investing!