With Bali Tourism on December 2024 high season fast approaching, we have estimated that there are currently between 14,000 and 15,000 villas available across Bali and estimated between 560,000 to 850,000 tourists will arrive, which presents a highly competitive market for property owners. As high season blooms, particularly for tourists from Australia, Singapore, and Malaysia, villa owners need to stand out through unique amenities, strategic pricing, and targeted marketing.

The appeal of popular locations varies greatly: areas like Seminyak, Canggu, and Uluwatu cater to tourists seeking vibrant nightlife and upscale amenities, while family-friendly areas such as Ubud and Jimbaran attract guests interested in cultural and group-oriented stays. By tailoring accommodations to specific demographics—such as providing 2-3 bedroom layouts for young travelers or family-friendly amenities—villa owners can optimize both occupancy rates and revenue.

I’m Jason, a business journalist at Bukit Vista, and I’m here to provide insights and trends for Bali’s villa owners as we approach the December holiday season. In this article, I’ll forecast Bali Tourism December 2024 tourist trends and provide data-driven insights to help villa owners capture the seasonal demand effectively.

Bali Tourism Forecast for December 2024

The forecast for Bali Tourism in December 2024 points to a steady, moderate increase in tourist arrivals. Using the year-over-year growth rate from September 2023 to September 2024 (16.85%), we project a total of approximately 560,000 tourists. However, applying the average monthly positive growth rate of 9.8% observed in 2024 would raise this figure to 850,000 tourists. Based on these historical growth rates, we can expect the December 2024 tourist numbers to range between 560,000 and 850,000.

This potential range reflects the gradual rebound in Bali Tourism post-pandemic, with tourists increasingly interested in destinations like Bali for the holiday season. Understanding where these tourists are likely to go within Bali, however, requires a closer look at recent social media engagement data.

Social Media Engagement Insights: Predicting Bali Tourist on December Flow Across Bali's Top Destinations

Based on social media data from Hootsuite on November, here’s a breakdown of the most engaging locations in Bali, offering clues about where tourists are likely to flock in December 2024. Each area draws distinct demographics and caters to specific interests, so the tourist flow will vary according to what each location offers:

1. Uluwatu: Leading Engagement and Positive Sentiment

- Results: 5,400 mentions

- Engagement: 47,700 (Highest across all locations)

- Sentiment Positive: 99.6%

- Authors: 363 mentions

Uluwatu’s blend of serene beaches, scenic cliffs, and surf culture has captured the social media spotlight, making it a prime destination within Bali Tourism. With the highest engagement and a nearly perfect sentiment score, Uluwatu appeals to those seeking adventure, natural beauty, and an escape from crowded urban areas. This region’s engagement indicates strong interest from tourists who value immersive, nature-centered experiences, further cementing its position as a key highlight of Bali Tourism.

High engagement levels (47,700) and a sentiment of 99.6% indicate that Uluwatu will be a hotspot, especially for adventurous young adults and surfers. We can expect a steady flow of tourists drawn to the area’s scenic beauty, surf spots, and serene atmosphere. Uluwatu’s appeal as a place to escape from crowded tourist hubs suggests longer stays and repeat visits, especially as tourists seek out eco-friendly, immersive experiences.

2. Kuta: High Visibility but Moderate Engagement

- Results: 12,000 (Highest number of mentions)

- Engagement: 19,600

- Sentiment Positive: 88.7%

- Authors: 1,600 mentions

Kuta, used to be a well-known highlight of Bali Tourism, somehow still remains a favorite destination for its vibrant nightlife and budget-friendly attractions. Despite having the most mentions and the highest visibility (12,000 results), its engagement is moderate at 19,600, with a sentiment score of 88.7%. This reflects Kuta’s appeal to budget-conscious travelers and nightlife enthusiasts, while also highlighting its highly urbanized and commercialized nature, which may limit deeper engagement with content. We are safe to say that Kuta is no longer a primadona for Bali, a lot of other areas are becoming like Kuta 15 years ago.

Kuta’s role within Bali Tourism is significant but often transient, with many visitors spending short periods in the area for specific experiences like bars, clubs, and beachfront events before moving on to quieter or less commercialized destinations. This pattern underscores Kuta’s importance as a lively, entry-point destination for diverse perhaps, older traveler profiles.

3. Ubud: Consistent Cultural Appeal

- Results: 6,100 mentions

- Engagement: 6,300

- Sentiment Positive: 97.1%

- Authors: 817 mentions

Ubud’s reputation as a cultural and wellness destination remains strong, with high positive sentiment but moderate engagement. Known for yoga retreats, art, and wellness, Ubud attracts tourists interested in cultural immersion. However, the engagement level suggests visitors see it as a place to relax rather than actively share on social platforms.

Known for its cultural and wellness appeal, Ubud’s sentiment score of 97.1% and engagement of 6,300 suggest a consistent influx of wellness seekers, art lovers, and those looking for a slower-paced experience. We anticipate steady foot traffic here, focusing on retreats, workshops, and longer stays due to Ubud’s reputation as a hub for spiritual and cultural enrichment.

4. Canggu: Trendy Appeal but Mixed Sentiment

- Results: 959 mentions

- Engagement: 3,000

- Sentiment Positive: 72.2%

- Authors: 391 mentions

Canggu appeals to young, digital-savvy tourists drawn to beach clubs, cafes, and co-working spaces. The engagement is decent, but the sentiment score is lower, likely due to overdevelopment, nightlife noise, and overcrowding. Canggu’s appeal to digital nomads remains strong, but improving infrastructure could enhance guest satisfaction.

Canggu’s engagement is relatively low (3,000), with a sentiment score of 72.2%, reflecting mixed perceptions within Bali Tourism. Despite this, the area remains a hotspot for digital nomads and younger travelers drawn to trendy cafes and co-working spaces. This demographic’s high turnover and preference for shorter stays suggest a dynamic and fluid tourist flow, with many visitors opting for short-term stays before moving on to other trendy Bali Tourism destinations like Seminyak and Uluwatu

5. Sanur and Nusa Dua: Low-Key but Positive Appeal

Sanur, with its high positive sentiment (98.8%) and 5,000 engagement points, is set to be a key destination within Bali Tourism for families and older tourists seeking a calm, family-friendly atmosphere. The flow in Sanur will likely be stable and consistent, as tourists favor longer stays and prioritize safety and relaxation over nightlife and trendy spots.

Nusa Dua, despite having the lowest engagement (288.8), maintains a high sentiment score of 96.3%, positioning it as a niche player in Bali Tourism. This suggests a steady yet limited flow of high-end tourists and resort-goers drawn to luxury and exclusivity. With its quieter, upscale appeal, Nusa Dua is likely to attract visitors who spend extended periods within resort complexes or exclusive beach areas, solidifying its role as a destination for premium experiences.

6. Seminyak: Upscale Vibe with Moderate Engagement

- Results: 843 mentions

- Engagement: 2,500

- Sentiment Positive: 95.6%

- Authors: 400 mentions

Seminyak’s upscale offerings, including boutique shopping and luxury dining, appeal to travelers seeking comfort and exclusivity. While engagement is moderate, the sentiment remains high, underscoring its appeal to those seeking a luxurious experience.

With an engagement level of 2,500 and a sentiment of 95.6%, Seminyak is set to attract tourists looking for luxury and upscale experiences. The flow here will likely consist of high-spending travelers seeking boutique shopping, fine dining, and stylish beach clubs. We expect a steady, moderate flow of tourists with longer stays, driven by Seminyak’s exclusivity and appeal to a more affluent crowd.

Expected Tourist Flow Summary

In December 2024, you can anticipate:

- High traffic in Uluwatu, driven by scenic and immersive experiences.

- Consistent, budget-oriented flow in Kuta, primarily for nightlife and beach activities.

- Steady inflow in Ubud for wellness and cultural experiences.

- Dynamic, shorter stays in Canggu, catering to digital nomads and young travelers.

- Moderate, affluent flow in Seminyak for upscale amenities and stylish events.

- Stable, family-focused traffic in Sanur for safe, relaxing environments.

- Limited, exclusive flow in Nusa Dua for luxury-oriented tourists.

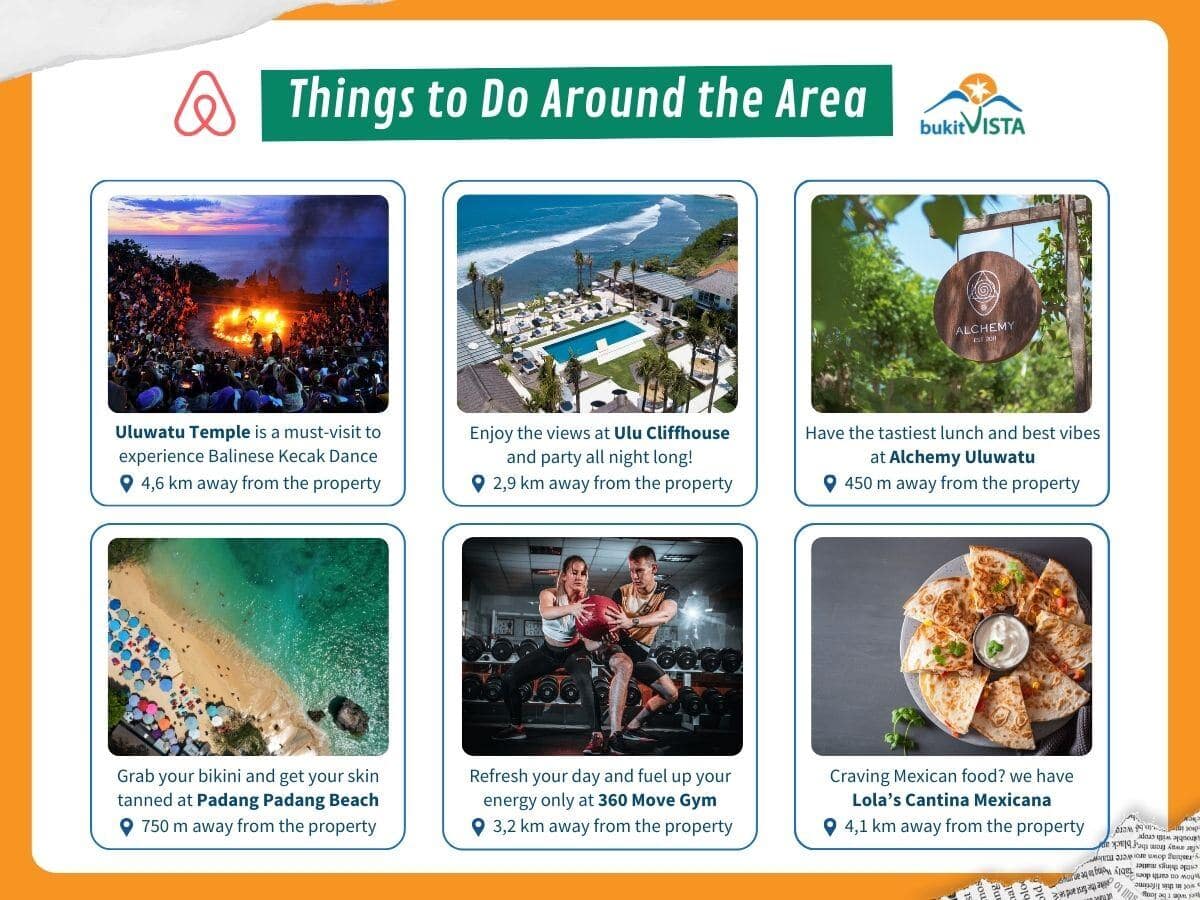

Uluwatu continues to attract travelers worldwide, thanks to its stunning beaches, lively dining scene, and iconic cultural landmarks. To truly ride the surge wave on December, preparing and finding the perfect stay is key. One of our standout properties in the heart of Uluwatu is the Uluwatu Surf Loft: Santorini Elegance. Located just a short walk from Padang Padang Beach, this charming loft combines Mediterranean-inspired elegance with modern comforts.

Guests enjoy access to an on-site restaurant, a shared swimming pool, and a curated guide to the best local attractions. Explore Uluwatu like never before, with a stay that perfectly complements the area’s allure.

Check out one of our standout properties in the heart of Uluwatu: the Uluwatu Surf Loft: Santorini Elegance.

Final Thoughts on Bali Tourism Forecast for December 2024

As Bali Tourism prepares for a bustling December 2024, villa owners and property managers can leverage insights into tourist preferences and social media engagement to optimize their offerings. From Uluwatu’s nature-focused allure to Seminyak’s upscale charm, tailoring strategies to each area’s unique audience can help properties stand out in Bali’s highly competitive market. By emphasizing amenities, creating experiences, and adopting dynamic pricing, property owners can maximize both occupancy and guest satisfaction during this peak season.

At Bukit Vista, we are committed to helping investors and property owners thrive in the Bali Tourism market. Whether you’re considering your first investment or are an established owner, we aim to help you reach the top 1% in the market through expert property management and data-driven insights. Let us help you reach your property’s potential and secure long-term success in Bali’s dynamic landscape.

Contact us today to discover how Bukit Vista can elevate your property’s performance.

For a Hassle-Free Property Management or Investment Service, Please Contact Us!

Get the facts right with the most knowledgeable property manager in Bali